Introduction to Forex trading Charting

This aspect with the study course is going to give you a short overview from the a few primary types of charts that you simply will run throughout inside your Forex trading journey. The chart kind that I take advantage of, and that my members use, is candlestick charts, I feel forex trading candlestick charts do the most beneficial position at demonstrating the price dynamics inside of a market, considering the fact that their structure aids you to visualize the “force”, or lack thereof, that a certain price tag movement exhibited. So, let’s go in excess of the three primary different types of charts which you will very likely see when you trade the markets:

• Line charts

Line charts are superior at providing you a fast look at of overall current market craze and aid and resistance amounts. They’re probably not useful to trade off of simply because you just can’t see the particular person value bars, however, if you ought to begin to see the craze of the sector inside a obvious fashion, you must have a look at the line charts of your respective popular markets from time to time.

Line charts are made by connecting a line in the substantial cost of 1 interval into the high price tag with the upcoming, small to minimal, open up to open up, or close to close. By far, line charts that demonstrate a link from 1 closing cost to your subsequent would be the most valuable as well as most widely used; that is for the reason that the closing price of the current market is deemed the most vital, given that it establishes who won the fight amongst the bulls along with the bears for that time period. Let us check out an example of a daily line chart in the EURUSD:

• Bar charts

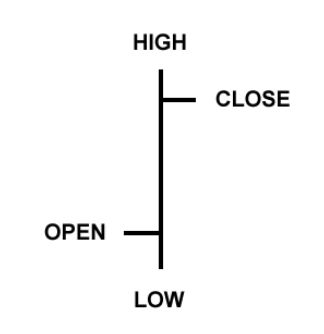

A bar chart reveals us a price tag bar for each length of time. So if you’re searching at a day-to-day chart you will notice a selling price bar for each day, a 4 hour chart will demonstrate you one rate bar for each 4 hour time period of time…etc. Somebody rate bar presents us four items of information that we can use to aid us make our trading choices: The open, high, minimal, and close, you may often see bar charts named OHLC charts (open, significant, small, near charts), here’s an instance of 1 value bar:

Here’s an example on the similar EURUSD chart we useful for the line chart example but for a bar chart:

• Candlestick charts

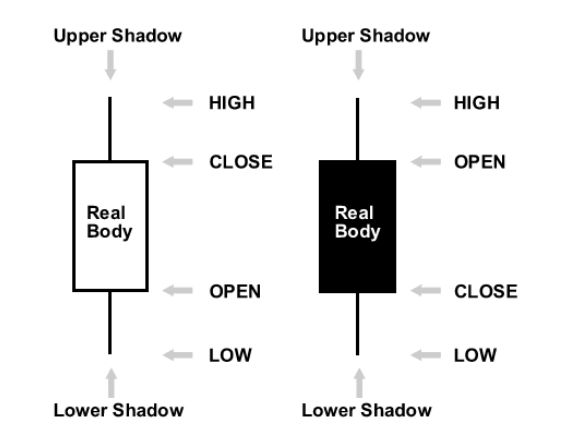

Candlestick charts show the same information and facts as being a bar chart but within a graphical format that is certainly far more entertaining to look at. Candlestick charts suggest the higher and reduced on the granted period of time just as bar charts do, by using a vertical line. The highest vertical line is known as the higher shadow when the bottom vertical line is known as the lower shadow; you might also see the higher and bring down shadows referred to as “wicks”. The leading variation lies in how candlestick charts exhibit the opening and closing price tag. The large block inside the center on the candlestick implies the array between the opening and closing value. Usually this block known as the “real body”.

Usually if the authentic human body is crammed in, or darker in colour the forex closed reduce than it opened, and when the real system is still left unfilled, or generally a lighter color, the forex shut larger than it opened. As an example, in the event the true human body is white or a further light colour, the top with the real entire body possible implies the near rate as well as the bottom of your real body implies the open selling price. In case the serious entire body is black or another darkish shade, the top in the genuine system most likely signifies the open up price and also the bottom signifies the shut cost (I utilized the word “likely” since you can make the real physique whatever coloration you wish). This will likely all turn out to be obvious having an illustration:

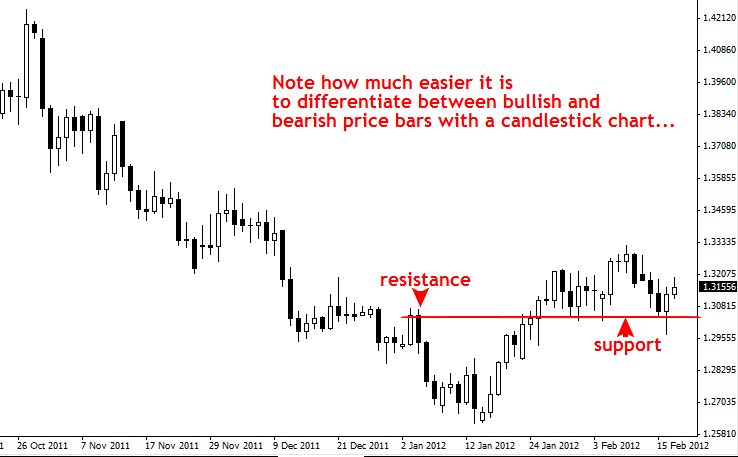

Now, here’s exactly the same EURUSD day-to-day chart that I showed you in line and bar type, as being a candlestick chart. Note that I’ve manufactured the candles black and white, you’ll be able to choose what ever colours you’d like, just be sure these are friendly towards your eye but additionally they convey bullish and bearishness to you. Bullish candles are the white ones (near larger than open up) and bearish candles are the black ones (shut bring down than open):

Candlestick charts are classified as the most widely used of all a few important chart varieties, and as this kind of, they are the sort you will see most often when you trade, and they are also the type I like to recommend you employ any time you understand and trade with value motion techniques. I use candlestick charts in my Fx trading program, and i proposed all my members rely on them when posting up charts from the members’ forum, since their visual pleasantness and ease ensure it is a lot easier for everyone to understand from. To obtain precisely the same fx charts that myself and my college students use stop by the www.basicfx.com.